Canara Bank Deposit Rates

In Canara Bank Fixed Deposit account, a fixed sum of money is deposited for fixed tenure usually for a period from 7 days to 10 years. A higher interest rate is offered on fixed deposits which vary from bank to bank.

INTEREST RATES DEPOSIT ACCOUNTS - RATES AT A QUICK GLANCE – as per RBI format LOANS - RATES AT A QUICK GLANCE - as per RBI format: Got any Questions? Toll Free Numbers. Deposit shall be renewed automatically for a similar period on the date of maturity at the rate of interest applicable for the period as on the date of maturity, in the absence of any renewal instructions well in advance. Auto Renewal facility is not available for Canara Tax Saver Deposits, Capital Gains Accounts, Canara Samriddhi deposits.

A Savings Account is very beneficial with multiple advantages as detailed below:

(1) Earns Interest on your Savings

This is the first and foremost benefit of opening a savings account. It starts earning interest on your money as soon as it is deposited. The interest rate is decided solely by the bank and changes from time to time. Regular interest depends upon the balance of the savings account.

Interest rate in savings account ranges from 3.5% to 7%.

(2) Provides Security of Funds

There is no risk involved in your savings account. It is considered as one of the safest investment alternatives. It even offers you the opportunity to put your money into another investment whenever the time comes.

(3) No Lock-in Period

There is no lock-in period under savings account which means that you can withdraw your deposits anytime you need. There is no need to keep your money in this account for any specific period. You have full flexibility in withdrawal of amount from it.

(4) Offers Liquidity

You can withdraw the amount anytime 24X7 with the use of ATM card or debit card from your account during any emergency even when the bank is closed. In fact, being able to access your money when you need it, is one of the biggest benefit of having a savings account.

(5) Availability of Variety of Savings Account

Many banks offer comprehensive range of savings accounts from regular to premium suiting to your personal banking needs. There are different types of savings accounts offered by various banks that differ based on the interest rates and duration of time commitments. You can choose any of them which suits your financial objectives and requirements.

(6) Services of Customer Relation Manager

Now-a-days many of the banks engage a Customer Relation Manager (CRM) who will help not only solve your queries but also assist you in tax saving, investment, mutual fund schemes, insurance, bank procedures, etc. You need to just call your CRM and he/ she will assist you solve your problem.

(7) Online Banking Facilities

If you maintain a savings account, you can make many transactions online also such as payment of bills, fund transfers using RTGS/ NEFT or IMPS, etc. This will save your time and efforts.

(8) Provides ATM/ Debit Card

You will be offered a debit or ATM card with a nominal charge or without any charges, as offered by your bank. With the help of this card, you can withdraw the funds, make transactions in shops, make payments of bills, etc.

(9) Helps you Get Credit or Loan

The relation you maintain with the bank will help you in getting credits from the bank such as home loan, personal loan. You will also be in a position to negotiate with the banker on the interest rates.

(10) No Cap on Deposits

There is no limit on the amount deposited and number of times it is deposited.

(11) Facility to link Loan EMIs, Mutual Fund SIPs or RD deductions

You get a facility to link your monthly loan EMIs, Mutual Fund SIPs or RD deductions through the savings bank account.

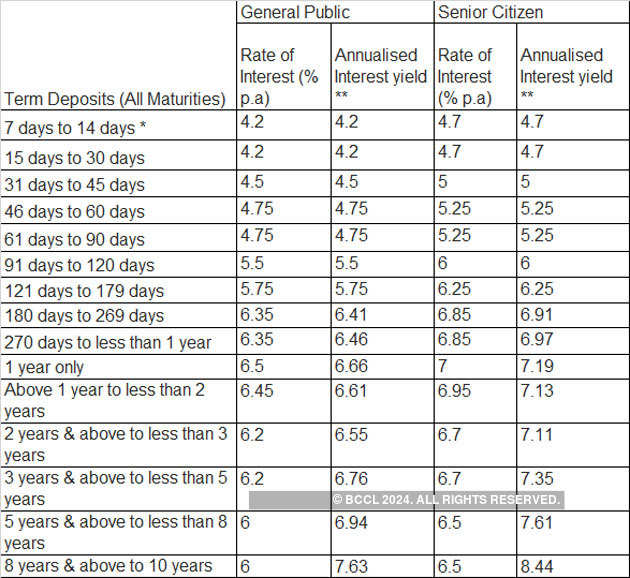

Canara Bank FD Rates: Latest Fixed Deposit Interest Rate 2021

(12) Free Mobile App

Most of the banks provide their mobile app for free. Through this app, you can get to know your account balance, check your statement, make transactions, easy transfer of money, etc.

Canara Bank Deposit Rates 2021

ELIGIBILITY | Individual, Joint (not more than 4), a Guardian on behalf of a minor, HUF, Partnership, a Company, Association or any other Institution |

INVESTMENT | Minimum - Rs.1000 |

PERIOD OF DEPOSIT | Minimum 15 days (7-14 days – Only for single deposit of Rs.5 lakh and above) |

INTEREST RATE | Depending upon the period of the deposit as prevailing from time to time. |

PERIODICITY OF INTEREST PAYMENT | Monthly (at discounted rates), Quarterly, Half-yearly or Annual intervals as per depositor's choice |

SPECIAL RATE FOR SENIOR CITIZEN | Additional interest rate of 0.50% will be paid for domestic term deposits (including RD and except for NRO, NRE and Capital Gains Deposit scheme) of less than Rs. 2 Cr and with tenor of 180 Days and above, over and above the rate offered for General public. The system will automatically enable preferential ROI of 0.50% to all existing eligible Domestic Term Deposits and RD Deposits from the date of Customer attaining Senior Citizen status w.e.f. 24.07.2018 In case of death of the Senior Citizen before the date of maturity, the deposit may be continued with the contracted interest rate only if there is no change to the other contracted terms. |

TDS ON INTEREST | Applicable |

NOMINATION FACILITY | Available |

LOAN FACILITY | Available upto 90% of the deposit amount |

PENALTY FOR PREMATURE CLOSURE/ PART WITHDRAWAL / PREMATURE EXTENSION OF DEPOSIT: | A penalty of 1.00% shall be levied for premature closure/part withdrawal/premature extension of Domestic/NRO term deposits of less than Rs. 2 Crore that are accepted /renewed on or after 12.03.2019. For premature closure/part withdrawal/premature extension of Domestic/NRO term deposits, the Bank imposes a penalty of 1.00%. Such prematurely closed/part withdrawn/prematurely extended deposits will earn interest at 1.00% below the rate as applicable for the relevant amount slab as ruling on the date of deposit and as applicable for the period run OR 1.00% below the rate at which the deposit has been accepted, whichever is lower.” A penalty of 1.00% is waived in case of premature closure/part withdrawal/ premature extension of Domestic/NRO CALLABLE term deposit of Rs. 2 Crore & above that are accepted/renewed on or after 12.03.2019. However, a penalty of 1.00% shall be levied for premature closure/part withdrawal/premature extension of Domestic/NRO term deposits of Rs.1 Crore & above that are accepted /renewed from 04.02.2011 to 12.10.2012 Such prematurely closed/part withdrawn/prematurely extended deposits will earn interest at the rate as applicable for the amount slab of Rs.2 Crore & above as ruling on the date of deposit and as applicable for the period run OR the rate at which the deposit has been accepted, whichever is lower No interest will be payable on term deposits prematurely closed/prematurely extended before completion of 7th day. A penalty of 1.00% is applicable on Term Deposits under Capital Gains Account Scheme-1988, which are prematurely converted/withdrawn/closed, irrespective of the size of the deposit amount. |

EXTRA FACILITY | Facility of part withdrawal of deposits in units of Rs.1,000/- keeping the rest of the deposit to earn contracted rate of interest. |

AUTO RENEWAL OF DEPOSIT | Deposit shall be renewed automatically for a similar period on the date of maturity at the rate of interest applicable for the period as on the date of maturity, in the absence of any renewal instructions well in advance. Auto Renewal facility is not available for Canara Tax Saver Deposits, Capital Gains Accounts, Canara Samriddhi deposits(discontinued w.e.f. 01.10.2015), Canara Khazana and Shikhar Deposits (discontinued w.e.f. 26.03.2020) and Non-callable deposits. |

OVERDUE DEPOSITS | a) The deposit will be renewed automatically from the date of maturity for a similar period at the interest rate prevailing on the date of maturity for the period of deposit, if automatic renewal has been opted by the depositor at the time of opening of the deposit account (except deposits opened under Capital Gains Scheme, Canara Tax Saver Scheme & Non-callable term deposits). b) If automatic renewal of the deposit is not opted by the depositor and the deposit remains with the Bank after the date of maturity (even if the CBS system renews the deposit automatically), the same will be treated as an overdue term deposit from the date of maturity of the original deposit. The overdue term deposit will be paid interest at prevailing Savings Bank rate for the overdue period, i.e. from the date of maturity of the original deposit till the date of payment/ re-investment. |

APPLICATION & DOCUMENTS | Application in the Banks’ prescribed form. Copy of PAN Card / Form 60 or 61 (if customer does not have PAN Card). Photograph of Depositor/s (2 copies). Proof ofIdentity and address as per KYC Norms. Any other related documents as applicable to proprietor ship concern, Partnership Firm, Company, HUF etc. |