Dda Account

DDA Personal Account

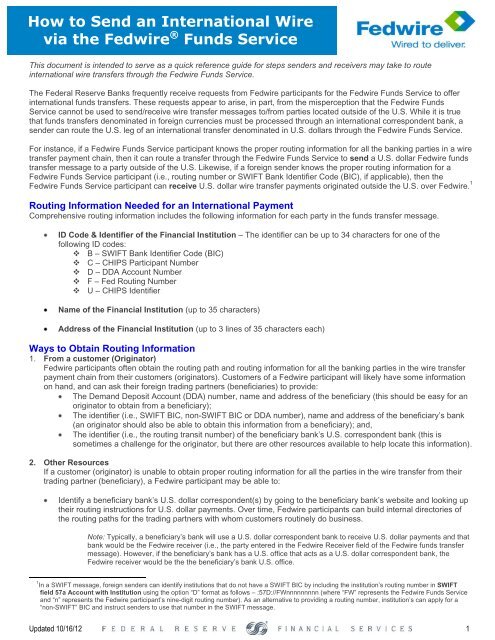

- Dec 13, 2020 The term DDA is used in banking, and financial institution stands for “ Demand Deposit Account.” This checking account is for those who deposit or withdraw funds often. In a DDA account, you get facilitate to transfer money or withdraw funds anytime without even visiting your bank.

- That particular DDA account is set up and used only for this process, and works in the following manner: The customer uses card that taps into a DDA account that has a zero balance. The account automatically advances the amount of the transaction into the DDA account. So the account is debited, shows a negative balance, which is then zeroed out.

Accounting DDA abbreviation meaning defined here. What does DDA stand for in Accounting? Get the top DDA abbreviation related to Accounting. A DDA is, for all intents and purposes, a checking account. It is a financial transaction vehicle where the money deposited into the account is made immediately available for transactions.

| Minimum Balance Requirements |

|

| Processing Order |

|

| Transaction Limitations |

|

DDA Student Account

| Eligibility Requirements |

|

| Minimum Balance Requirements |

|

| Processing Order |

|

| Transaction Limitations |

|

DDA Personal Account – Age 65 and over

Dda Account Number

| Eligibility Requirements |

|

| Minimum Balance Requirement |

|

| Processing Order |

|

| Transaction Limitations |

|

MMA Personal Account

| Variable Rate Information |

|

| Compounding and Crediting |

|

| Minimum Balance Requirements |

|

| Processing Order |

|

| Balance Computation Method |

|

| Accrual on Noncash Deposits |

|

| Transaction Limitation |

|

| Current Rate Information |

|

Dda Account Type

Dda Account Clo

NOW Personal Account

Dda Account Banking

| Eligibility Requirements |

|

| Variable Rate Information |

|

| Compounding and Crediting |

|

| Minimum Balance Requirements |

|

| Processing Order |

|

| Balance Computation Method |

|

| Accrual on Noncash Deposits |

|

| Transaction Limitations |

|

| Current Rate Information |

|