For Mobile Deposit Only

Your bank can cap how much you can deposit. Banks will typically place a limit on the dollar amount.

- Navy Federal’s Mobile Deposit service is offered through our Mobile Banking. app, which requires you to provide a unique username and password each time you log in. Each item to deposit must be endorsed with the signature of the payee and “For eDeposit Only at NFCU.”.

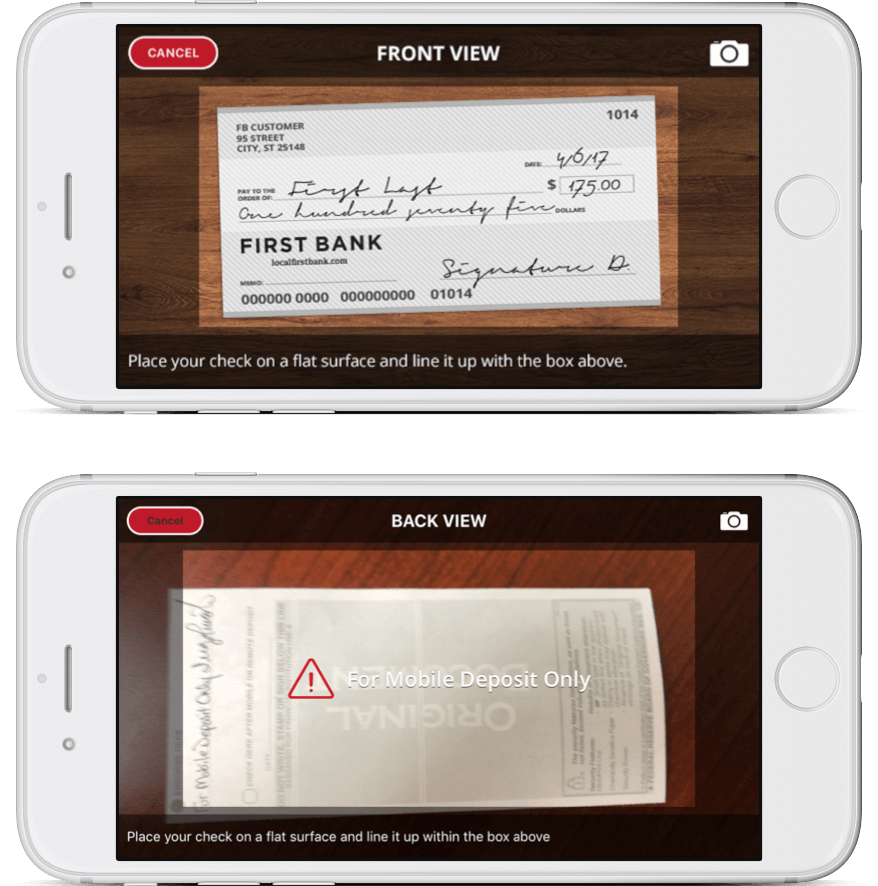

- With Mobile Deposit, you can use your smartphone's camera to take a picture of the check and deposit it to your account. Once approved, your deposit goes directly into your account. Fast and simple. Deposit checks 24/7 with your Android, iPhone or iPad – no need to visit a banking center, or ATM; Convenient deposit cut-off time of 6pm CT.

For Mobile Deposit Only Bank Of America

- Can I view a copy of my check after it has been deposited?

Yes, select “View mobile deposit history” to view the front and back of a check image that was submitted within the last 30 days. If you need to see a check image that is outside of the 30 days, please contact Member Services at 1-800-645-4728.

- What are the deposit limits?

$15,000.00 limit per deposit with a $15,000.00 limit per day.

- Do I need to endorse the check I am depositing?

Yes. You must endorse your check as follows: 'For Mobile Deposit Only' and your signature.

- When will the funds be deposited and available within my account?

Funds will be deposited into your account within two (2) business days and will follow GSCU's regular funds availability schedule. Please refer to our Funds Availability Disclosure.

- What types of check deposits are NOT accepted through Mobile Deposit?

1) Any item that is stamped with a 'non-negotiable' watermark.

2) Any item that contains evidence of alteration to the information on the check.

3) Any item issued by a financial institution in a foreign country.

4) Any item that is incomplete.

5) Any item that is 'stale dated'* or 'post dated'**.

6) Savings Bonds.

7) Third party checks***.

*Stale dated checks are defined as any check that is being negotiated more than six months after the date on the check.

**Post dated checks are defined as any check that is deposited before the date on the check.

***Third party checks are defined as checks that have been transferred by the original payee to a third party by means of an endorsement. - Will I be notified if my check is not accepted or if it is rejected?

Yes, our eServices department will notify you via email.

If your check is rejected you can visit any one of our convenient locations to deposit the check. You can also mail your deposit to:

Granite State Credit Union

PO Box 6420

Manchester, NH 03108 - What is Mobile Deposit?

Mobile Deposit allows members to deposit checks utilizing their smartphone or tablet devices. You can deposit money in all of your GSCU share accounts.

- Who do I contact if I encounter an issue?

Please contact a Member Services Representative at 1-800-645-4728 or send an email to eservices@gscu.org.

- What do I do with the physical check once it has been deposited?

The physical check should be retained in a secure location for a period of ninety (90) days. After this period expires you can destroy the check.