Pnb Interest Rates

Find Punjab National Bank NRE FD Interest Rates (as on 02 Mar 2021). The interest rates for below 1 crore and above 1 crore on fixed deposit depend on which category you fall under and your choice between different banks. Punjab National Bank offers NRO Fixed deposit interest rates. .Rates of interest are subject to change at the sole discretion of PNB Housing. PNB Housing offers floating rate of interest, linked to its benchmark rate PNBHFR: PNBHFR for existing customers (loan.

- Pnb Interest Rates For Time Deposits

- Pnb Interest Rates On Personal Loan

- Pnb Interest Rates On Savings Account

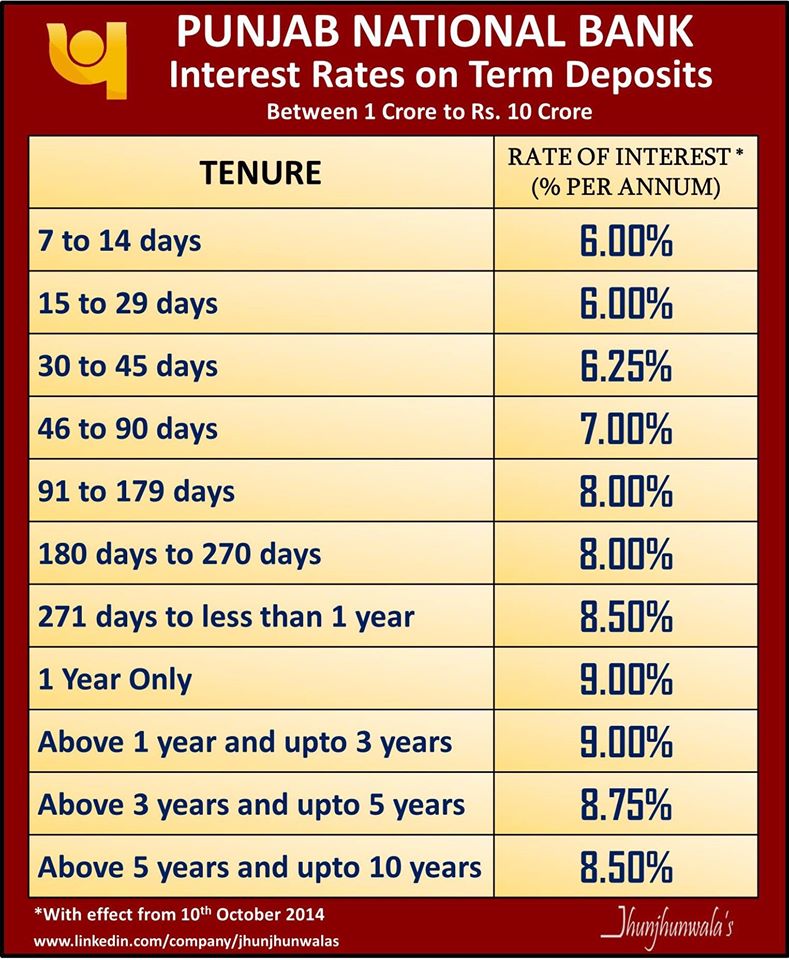

Pnb Interest Rates For Time Deposits

| PNB Housing Loan |

The facility can be utilized for any of the following purposes:

|

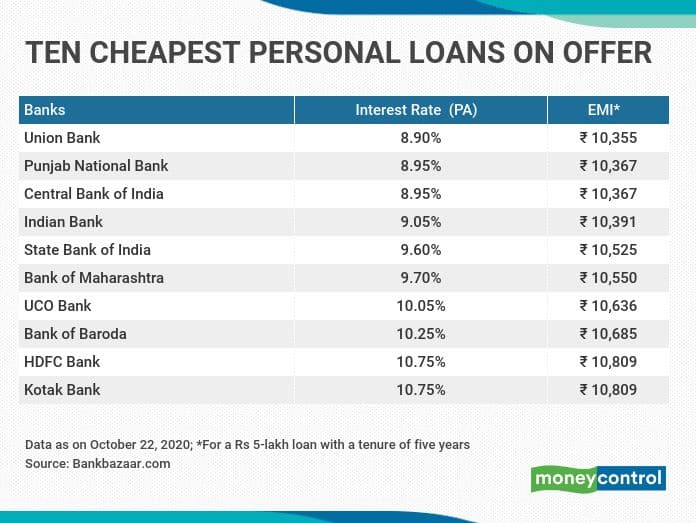

Pnb Interest Rates On Personal Loan

| PNB Auto Loan |

The facility can be utilized for purchase of brand new or second hand cars. Maximum loanable amount shall be as follows:

|

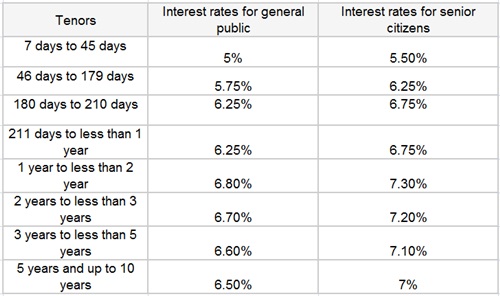

Pnb Interest Rates On Savings Account

| PNB Housing Loan |

The facility can be utilized for any of the following purposes:

|

| PNB Auto Loan |

The facility can be utilized for purchase of brand new or second hand cars. Maximum loanable amount shall be as follows:

|

| Bank Name | Floating Interest rate | Per lac EMI | Benchmark Rates on | Processing Fee | Prepayment Charges | % Change in last 6 mths | |

| SBI - State Bank Of India | 6.70% - 6.75% | Rs.757 - Rs.760 | 8.15% | 0.35% of loan amount + GST, Nil for Govt. Employees | Nil |

| |

| ICICI Bank | 6.70% - 7.90% | Rs.757 - Rs.830 | 8.75% | Flat Rs 3000 /- + AT | N.A |

| |

| HDFC Ltd | 6.70% | Rs.757 - Rs.0 | 16.20% | Up to 1.25% of the loan amount or ₹ 3,000 whichever is higher, plus applicable taxes | Nil |

| |

| LIC Housing | 6.90% - 7.00% | Rs.769 - Rs.775 | 14.60% | NIL upto 50 Lakh, 50% waiver on loan above 50 lakh to 5 Cr | Nil | No Change | |

| Bank of Baroda | 7.25% - 8.25% | Rs.790 - Rs.852 | 8.75% | Upto 0.5 % of loan amount + GST | N.A. | No Change | |

| AXIS Bank | 7.75% - 8.40% | Rs.821 - Rs.862 | 8.8% | Up to 1% of the Loan amount subject to minimum of Rs.10,000/- | Nil |

| |

| PNB Housing Finance | 7.35% - 9.05% | Rs.796 - Rs.903 | 0.50% Or 10,000 + GST , whichever is higher. | NIL | No Change | ||

| IDBI | 7.80% - 8.80% | Rs.824 - Rs.887 | 8.7% | NIL | Nil |

| |

| Union Bank of India | 6.70% - 7.10% | Rs.757 - Rs.781 | 8.65% | 0.50% of loan amount subject to a maximum of 15000 + GST | NIL |

| |

| Bank of India | 6.85% - 7.75% | Rs.766 - Rs.821 | 8.55% | 0.25% of loan amount Min.Rs.1,000/- and Max. Rs.20,000/- | Nil |

| |

| Piramal Housing Finance | 9.50% | Rs. 932 | N.A | 0.10% - 0.25% (GST) | N.A | ||

| DHFL | 9.75% | Rs.949 | 19.07% RPLR | Upto Rs. 20,000 + document charges + GST | Nil |

| |

| Indiabulls Housing Finance Limited | 8.99% onwards | Rs.880 - Rs.1029 | 9.50% | 0.50% to 1.00% + GST | NIL |

| |

| Corporation Bank | 6.70% - 7.10% | Rs.757 - Rs.781 | 8.65% | NIL | NIL | No Change | |

| L&T Housing Finance | 8.35% | Rs.858 | 0.25% plus taxes (for salaried & for self employed) | NIL | |||

| United Bank of India | 7.00% - 7.60% | Rs.775 - Rs.812 | 8.80% | 0.59%, Minimum Rs.1180/-; Maximum Rs.11800/- | N.A | ||

| Tata capital Housing Finance ltd | 9.25% onwards | Rs.916 onwards | Upto 0.5% of loan amount + GST | N.A | N.A | ||

| HSBC Bank | 8.55% - 8.65% | Rs.871 - Rs.877 | 8.15% | N.A | Nil | N.A | |

| Standard Chartered | 9.21% onwards | Rs.913 onwards | 8.95% | Rs.10000 + GST | NIL |

| |

| Federal Bank | 7.35% - 7.70% | Rs.796 - Rs.818 | 8.9% | Upto Rs.7500 + GST | N.A | No Change | |

| Allahabad Bank | 7.15% - 7.50% | Rs.784 - Rs.806 | 8.45% | N.A | NIL |

| |

| Central Bank of India | 6.85% - 7.30% | Rs.766 - Rs.793 | 8.50% | 0.50% of the Loan Amount subject to maximum Rs.20,000/- | Nil |

| |

| UCO Bank | 7.15% - 7.25% | Rs.784 - Rs.790 | 8.55% | 0.5% of the loan amount, minimum Rs.1500/- & maximum Rs. 15000/- | NIL |

| |

| Canara Bank | 6.90% - 8.90% | Rs.769 - Rs.893 | 8.60% | 0.50% of loan amount + GST |

| ||

| Kotak Bank | 8.65% - 9.15% | Rs.877 - Rs.909 | 8.95% | Upto 1.25% of Loan amount | Nil |

| |

| Syndicate Bank | 6.90% - 8.90% | Rs.769 - Rs.893 | 8.65% | N.A | N.A |

| |

| Citibank | 8.50% onwards | Rs.868 onwards | 8.45% | Rs. 5000 (Application fee) | NIL | No Change | |

| Oriental Bank of Commerce | 7.00% - 7.60% | Rs.775 - Rs.812 | 8.65% | 0.50% of the loan amount, subject to maximum of Rs.20000/- plus GST | NIL | No Change | |

| Indian Overseas Bank | 7.45% - 7.70% | Rs.803 - Rs.818 | 8.50% | 0.50 % (max. Rs.25,000/-) | N.A |

| |

| Indian Bank | 7.15% - 7.50% | Rs.784 - Rs.806 | 8.60% | 0.230% on loan amount + GST or Max Rs.20470/- | Nil |

| |

| Punjab National Bank | 7.00% - 7.60% | Rs.775 - Rs.812 | 8.45% | 0.50% of loan + GST | NIL |

| |

| Bank of Maharastra | 7.15% - 8.45% | Rs.784 - Rs.865 | 8.75% | As per applicable | Nil | No Change | |

| GIC Housing Finance | 9.10% - 12.50% | Rs.906 - Rs.1136 | Rs.2500 + GST | N.A | |||

| India Infoline Housing Finance Ltd. | 9.00% | Rs.900 | Upto 1% of loan amount + GST | N.A | |||

| Karnataka Bank | 8.59% - 9.14% | Rs.874 - Rs.909 | 8.95% | N.A | N.A | ||

| Reliance Home Finance Private Ltd. | 8.35% | Rs.858 | 18.40% PLR | Up to 2% + GST | N.A | ||

| Repco Home Finance Ltd. | 9.25% | Rs.916 | 8.75% | 1% of loan amount + GST | N.A |